Your AI Strategy is Already Obsolete

AI's pace is outpacing strategy. Mary Meeker's 2025 AI report reveals the new rules of competition, cost, and global power.

Mary Meeker's latest AI report confirms adoption is happening at a velocity that makes legacy strategies obsolete before they're even implemented.

A paradoxical economy has emerged, defined by billion-dollar training costs and near-zero usage costs, fueling intense competition and cash burn.

The race for AI dominance is now fundamentally geopolitical, reframing market competition as a high-stakes battle for global influence.

The legendary analyst who defined the internet era with her iconic Trends Reports, Mary Meeker is now a general partner at BOND, chronicling the rise of AI.

If you're a leader feeling like you're perpetually behind on AI, you're not wrong. Just as you get your head around the latest AI model, the entire landscape shifts. We're not just in another tech cycle; we're in a period of unprecedented, foundational change.

The venture firm BOND just released its massive May 2025 "Trends – Artificial Intelligence" report, and the data paints a stark picture for business leaders. The key insights aren't just about what AI can do, but about the new economic, competitive, and geopolitical realities it has created.

I’ve distilled all 340 pages of charts and analysis into the 10 core insights that matter for your strategy. Here are the new realities you need to understand to navigate what's coming, plus the three critical execution gaps the report doesn't address.

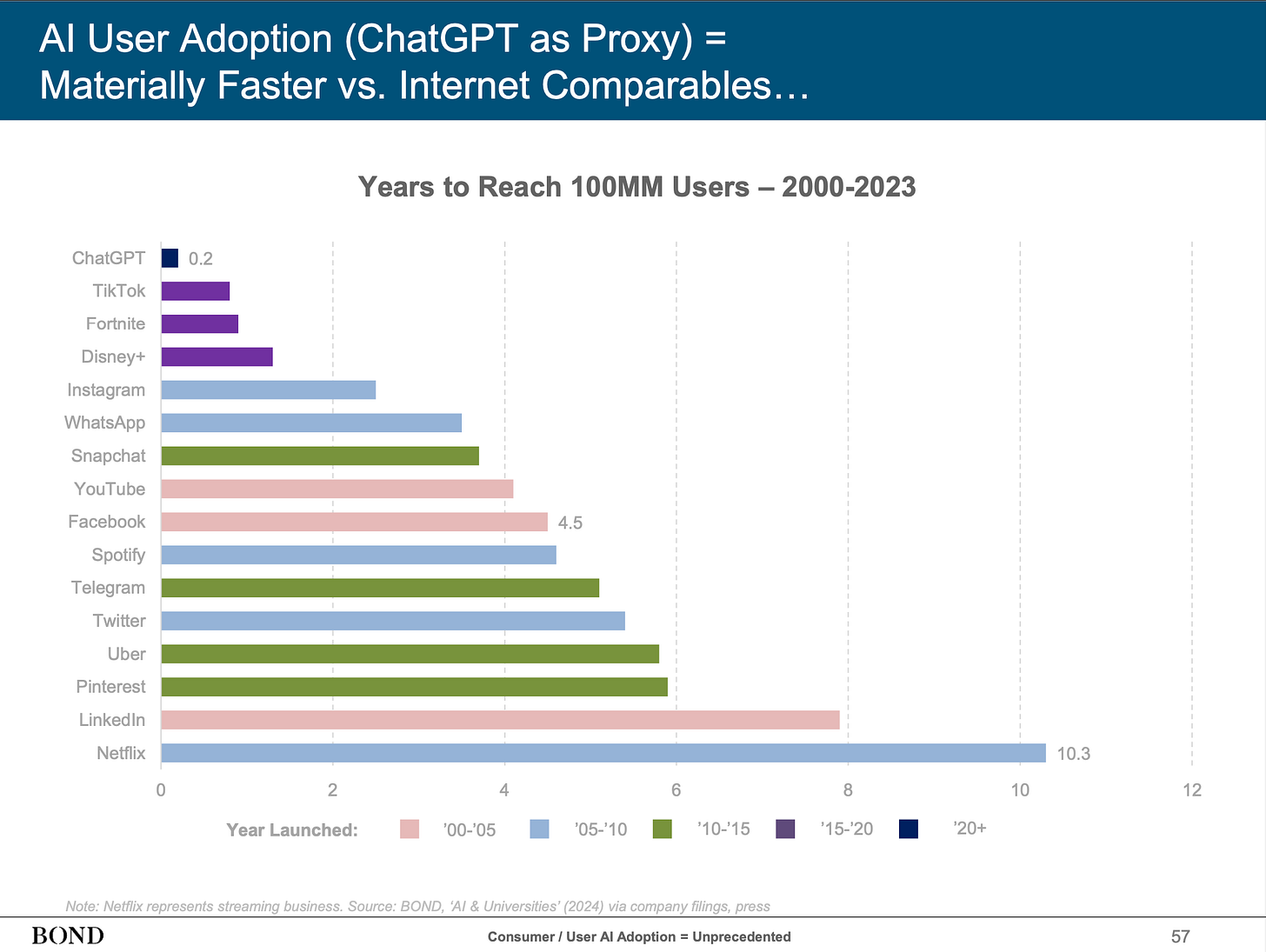

1. The Pace Isn't Just Fast, It's a New Category of Speed

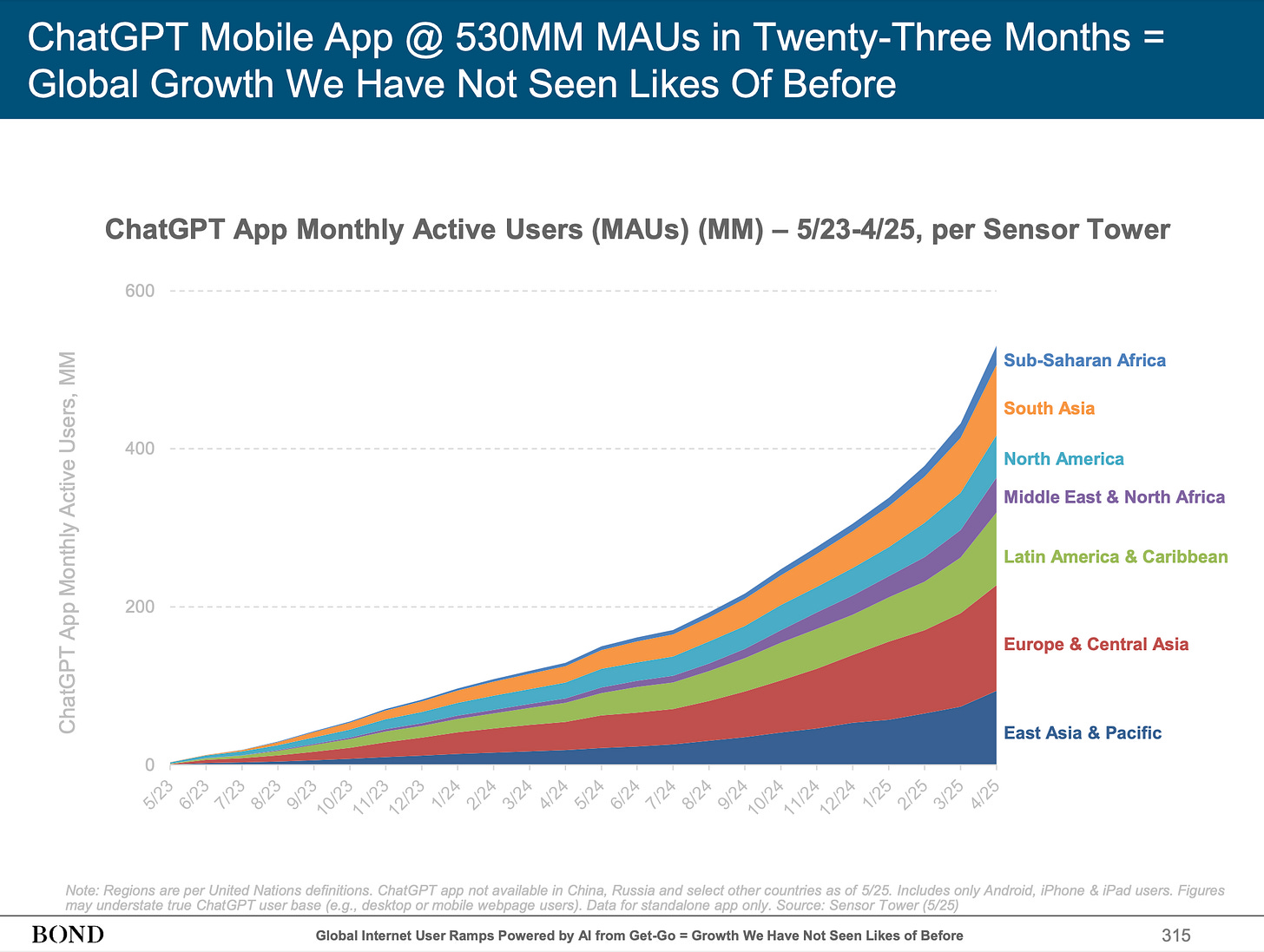

We often use "internet time" to describe rapid change, but AI makes that look like a stroll in the park. The BOND report highlights that it took ChatGPT just 0.2 years to hit 100 million users; it took the internet nearly two decades to reach a similar portion of its eventual user base. This isn't just an iteration. It's a complete re-acceleration of the adoption curve, built on the rails of the global internet and mobile distribution that came before it.

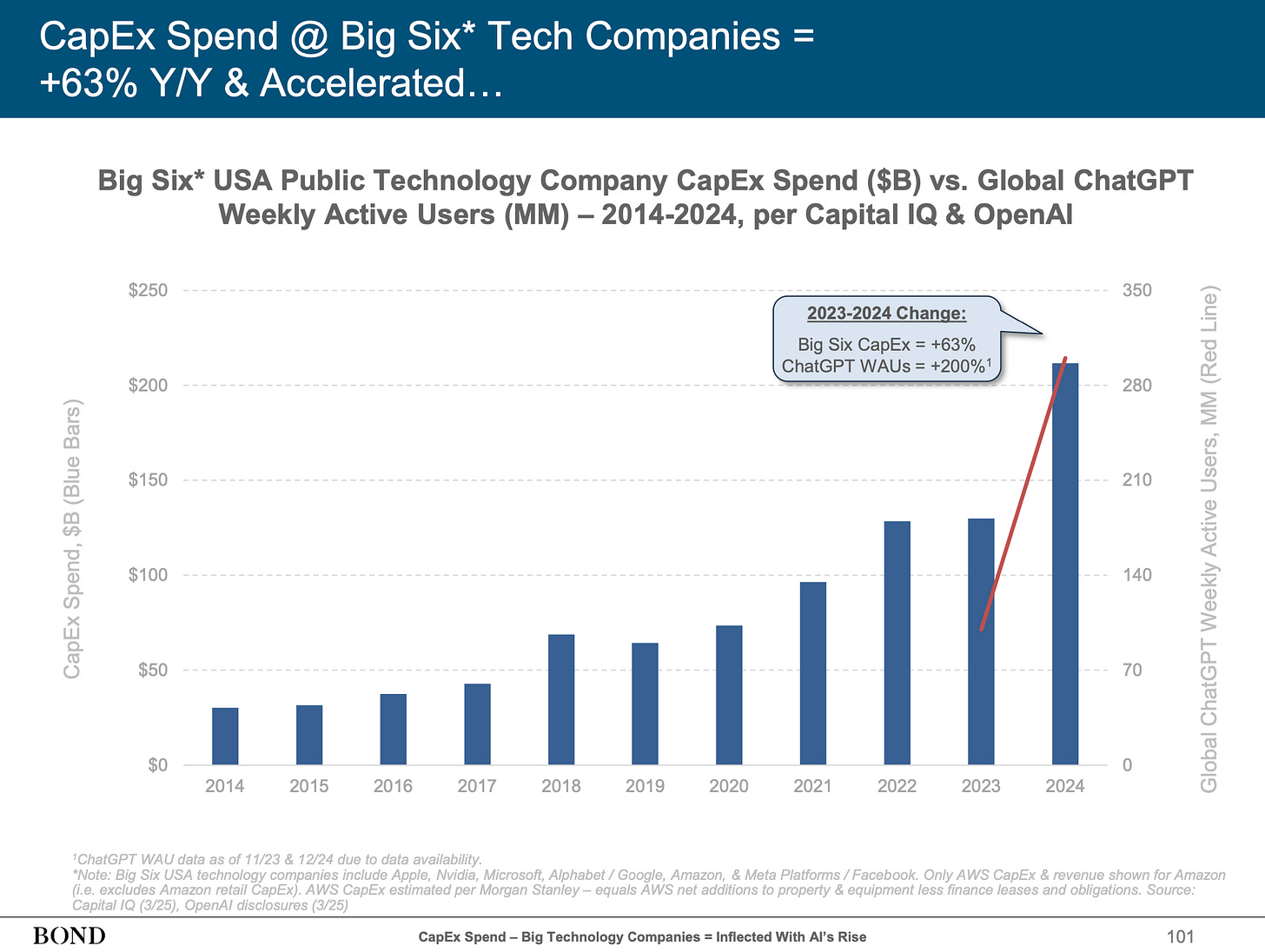

2. This Velocity is Fueled by an Unprecedented Capital Arms Race

This kind of speed isn't free. The "Big Six" US tech companies alone are now pouring over $200 billion a year into CapEx, a stunning 63% year-over-year increase. This isn't just investment; it's a strategic arms race to build the foundational infrastructure, from data centres to specialised chips, required to compete. The barrier to entry at the frontier model level is no longer millions, but billions, creating an immense moat for those with the balance sheets to fund it.

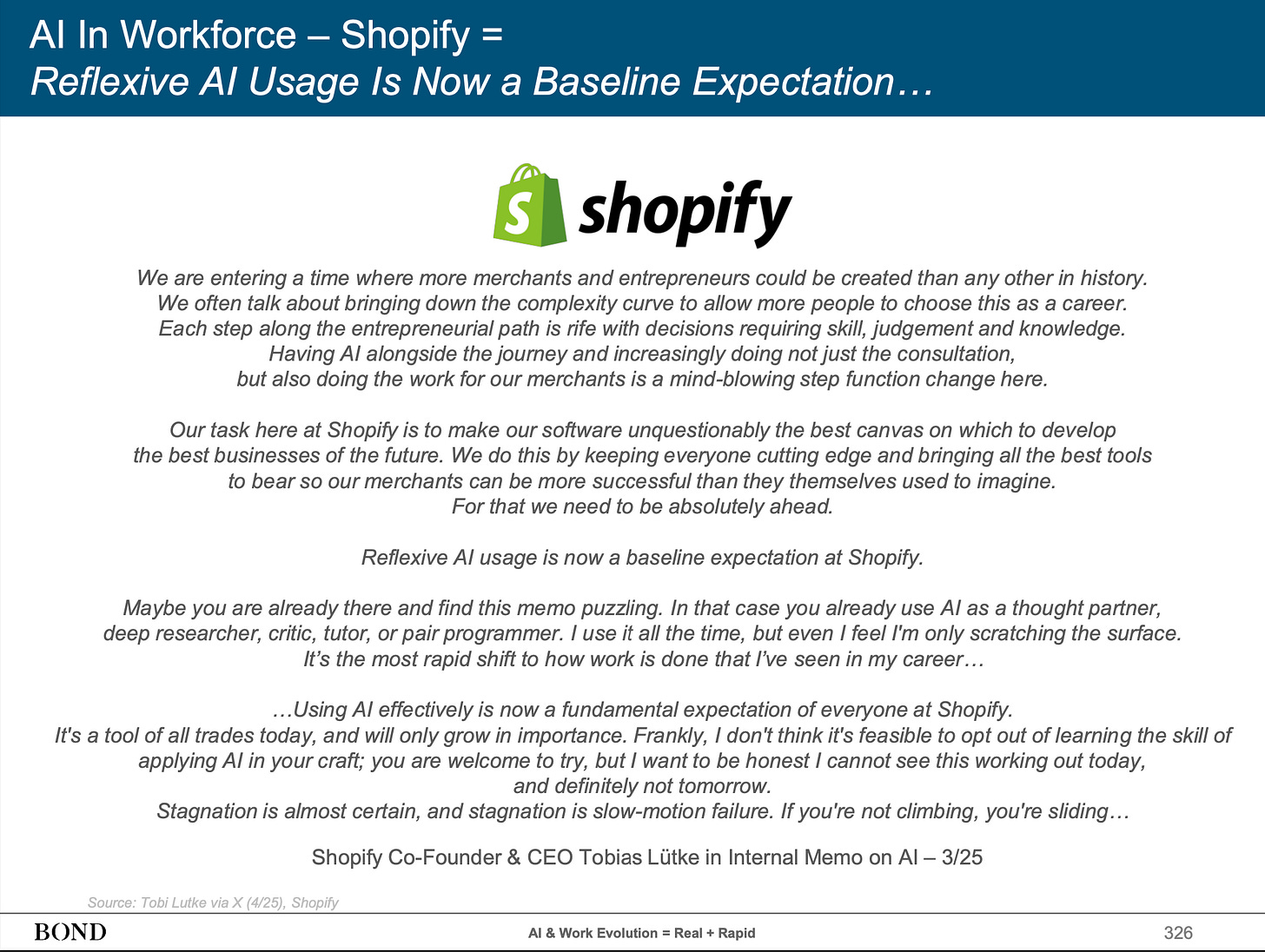

3. The External Race Creates Intense Internal Pressure

This external capital war is forcing a revolution inside your own company. As Shopify's CEO Tobi Lütke put it in a recent memo, "reflexive AI usage is now a baseline expectation." The days of AI being a specialised skill for a few data scientists are over. The report shows that proficiency with AI tools is rapidly becoming a non-negotiable requirement for knowledge workers, from developers to marketers. If you're not making it a core competency for your entire team, you're already falling behind in the war for talent and productivity.

4. The Core of AI is an Economic Paradox: It's Wildly Expensive and Nearly Free

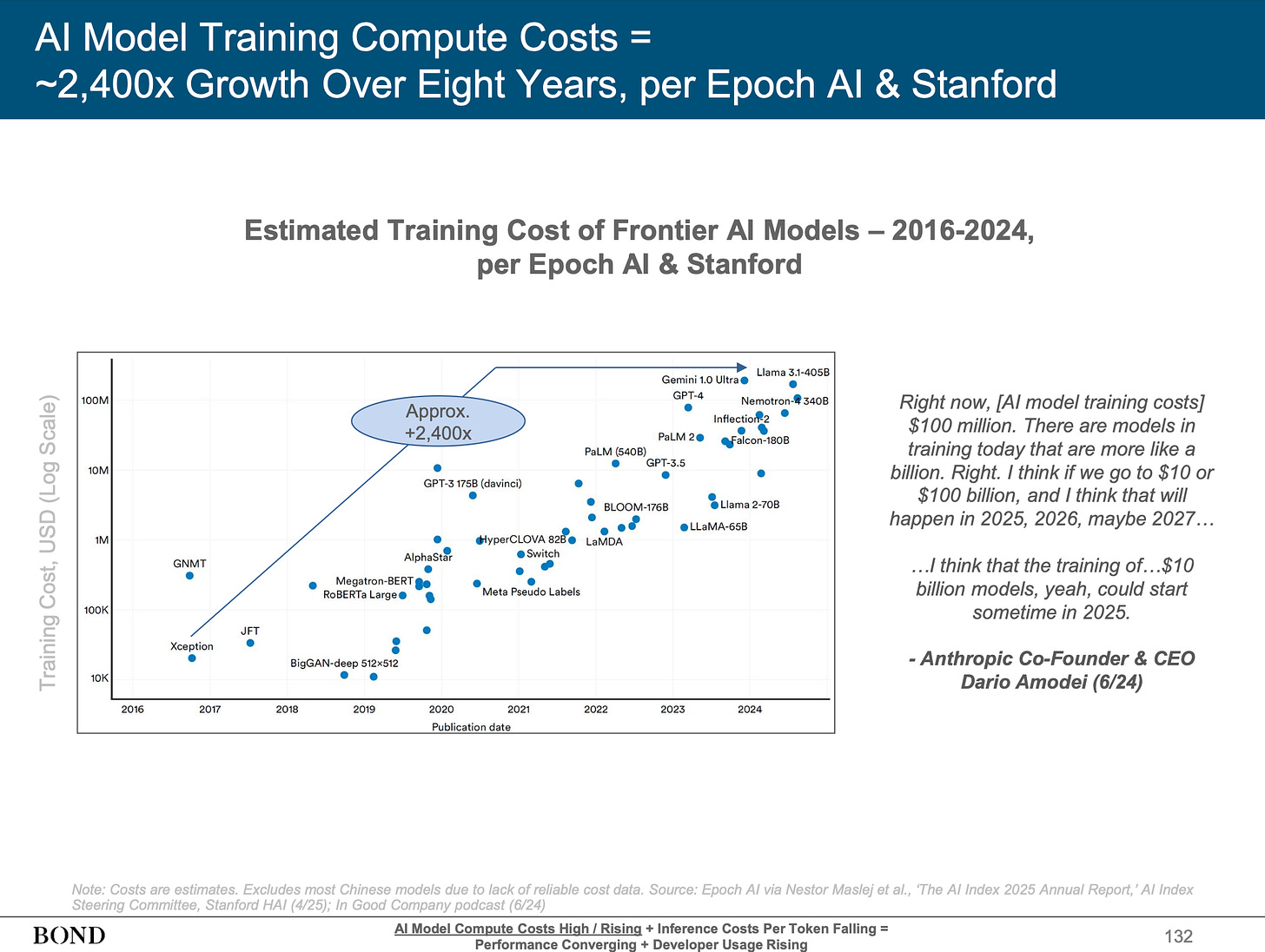

So, what's driving this chaos? A fundamental economic paradox. On one hand, the cost to train a new, state-of-the-art AI model is skyrocketing, growing 2,400x in just eight years and now pushing into the billions. On the other hand, the cost for a user to run a query on that model (inference) has plummeted by 99.7% in two years. This dynamic is the engine of the entire ecosystem: massive, high-risk upfront investment enables a nearly-free, high-volume service that fuels explosive adoption.

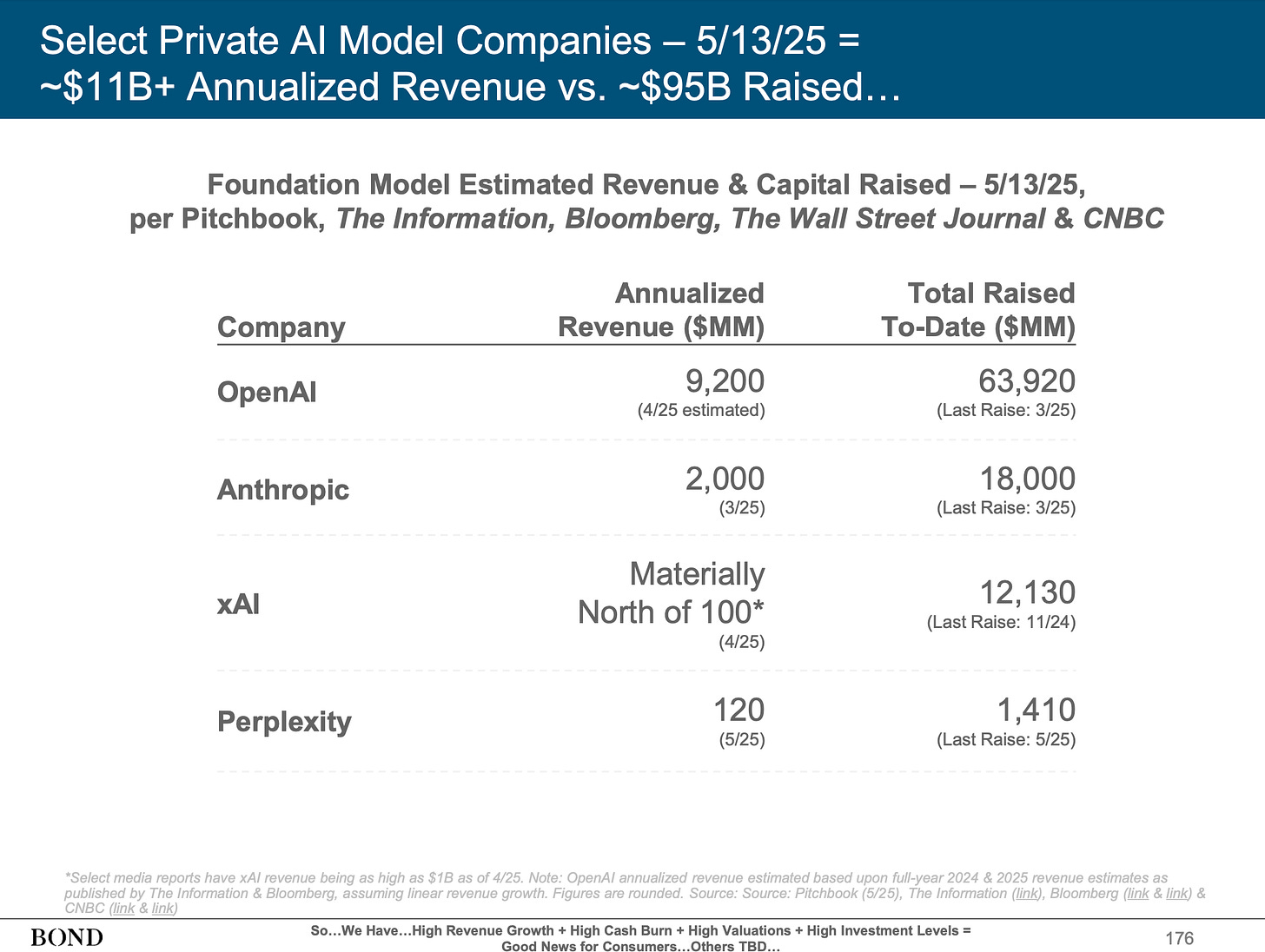

5. This Paradox Creates Massive Monetisation Headwinds

This leads to the $95 billion question. The report shows that the top private AI companies have collectively raised nearly $95 billion in capital while generating just over $11 billion in annualised revenue. While revenue growth is meteoric, the cash burn is staggering. Even with hundreds of millions of users, the path to profitability is unclear when the core service is in a race to zero on price, and the competition (both closed and open-source) is relentless.

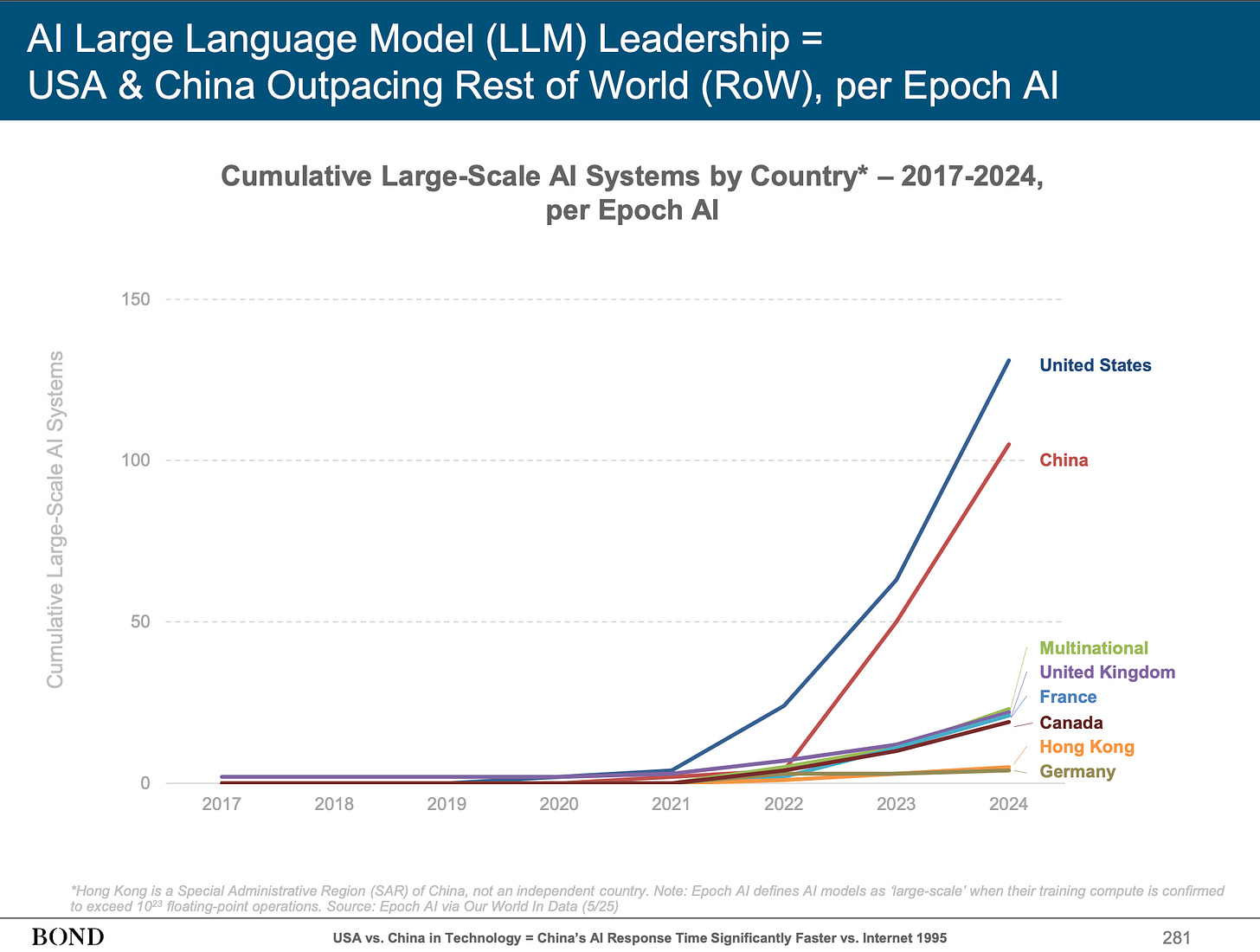

6. The Stakes Are Geopolitical, Not Just Commercial

As if the market dynamics weren't complex enough, this is not just a battle between companies. The report makes it clear that the AI race is the new space race. The competition between the US and rapidly advancing China for AI supremacy revolves around setting global standards, controlling technological dependencies, and exerting geopolitical influence. National strategy, from chip manufacturing to data sovereignty, is now inextricably linked to corporate strategy.

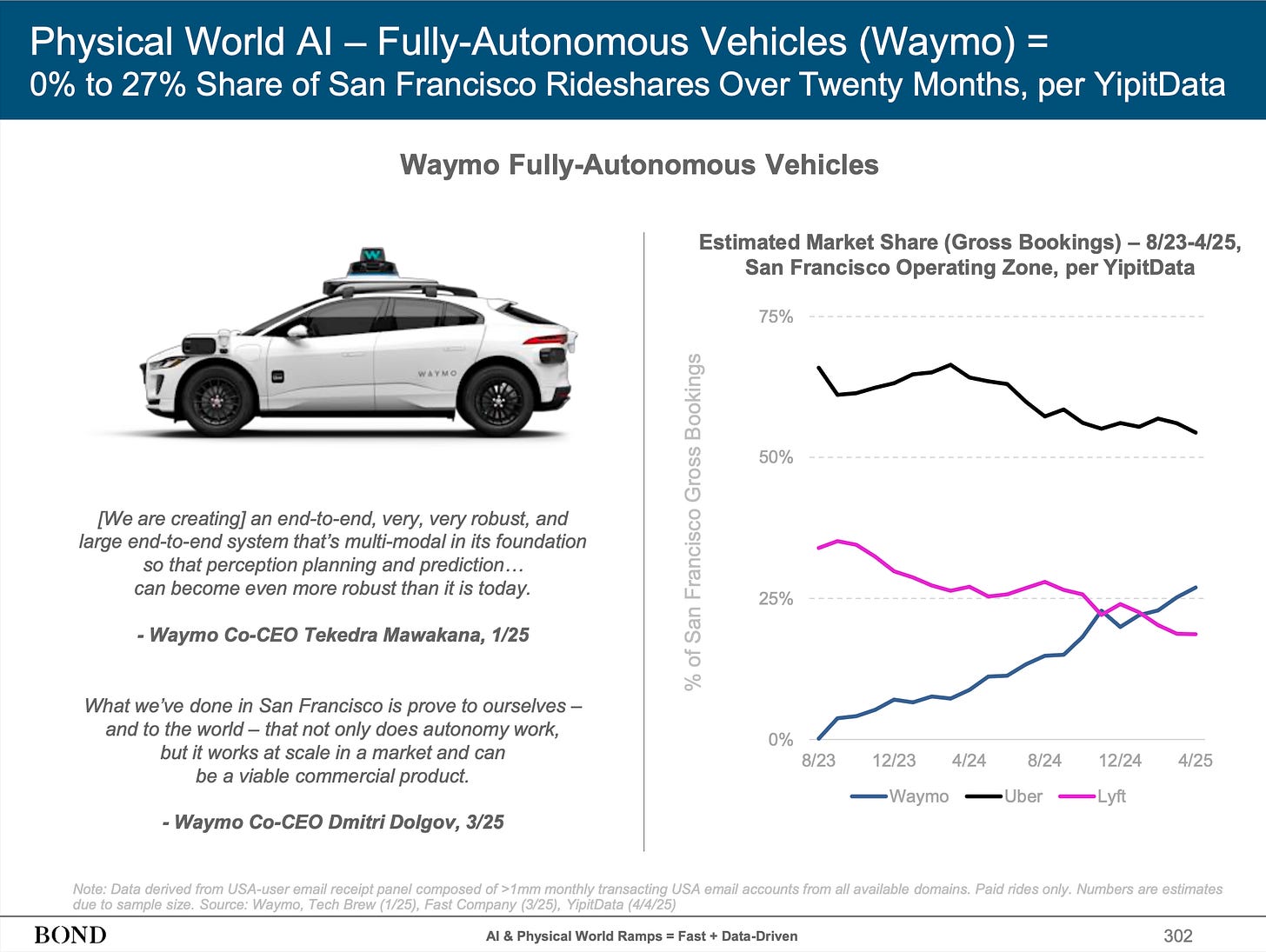

7. AI is Hitting the Pavement and Moving Dirt

While the headlines focus on chatbots, AI's impact is rapidly expanding into the physical world. The report demonstrates how autonomous systems are transitioning from research and development to real-world deployment at scale. Waymo has already captured over a quarter of the rideshare market in its San Francisco zone. Tesla's fleet has logged billions of fully self-driven miles. This is intelligence embedded in capital assets, turning everything from cars to farm equipment into kinetic, intelligent endpoints.

8. Consumer Scale Is Reaching Unprecedented Levels

In the digital world, the scale of consumer adoption is genuinely remarkable. A single leading large language model (LLM) now has an estimated 800 million weekly active users, with the vast majority coming from outside North America. This isn't a niche tech-savvy audience; it's a global phenomenon that happened almost overnight, creating a user base and data flywheel of unprecedented size.

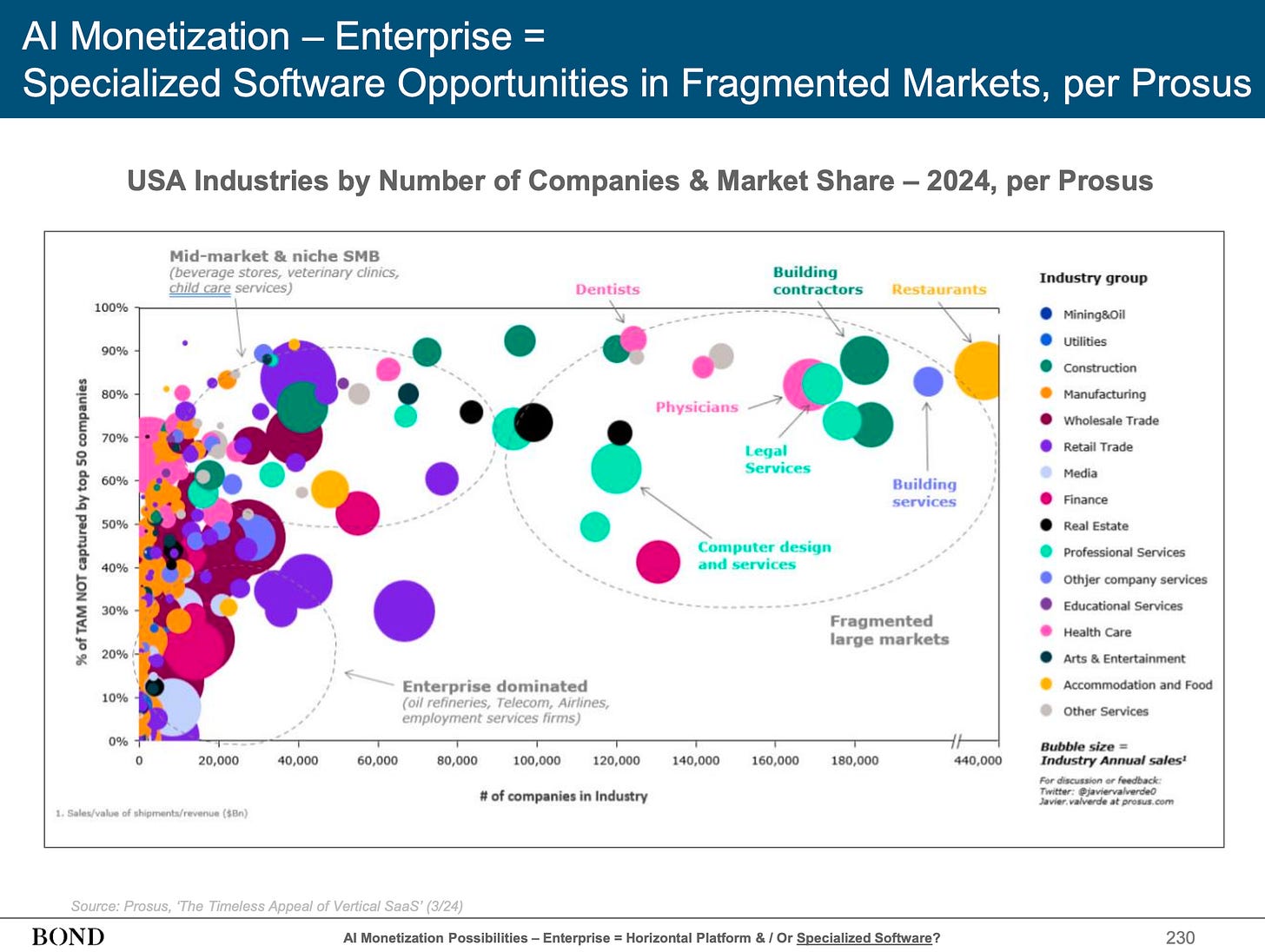

9. The Moat is Leaky: Fragmentation is the New Reality

You'd think this scale would create an unbreachable moat, but the report suggests the opposite. The plummeting cost of inference and the rise of powerful open-source models are enabling a new wave of specialised, vertical AI companies. These new entrants are growing at an incredible pace, tackling specific industry problems in areas such as healthcare, law, and software development, and chipping away at the one-size-fits-all model of the tech giants.

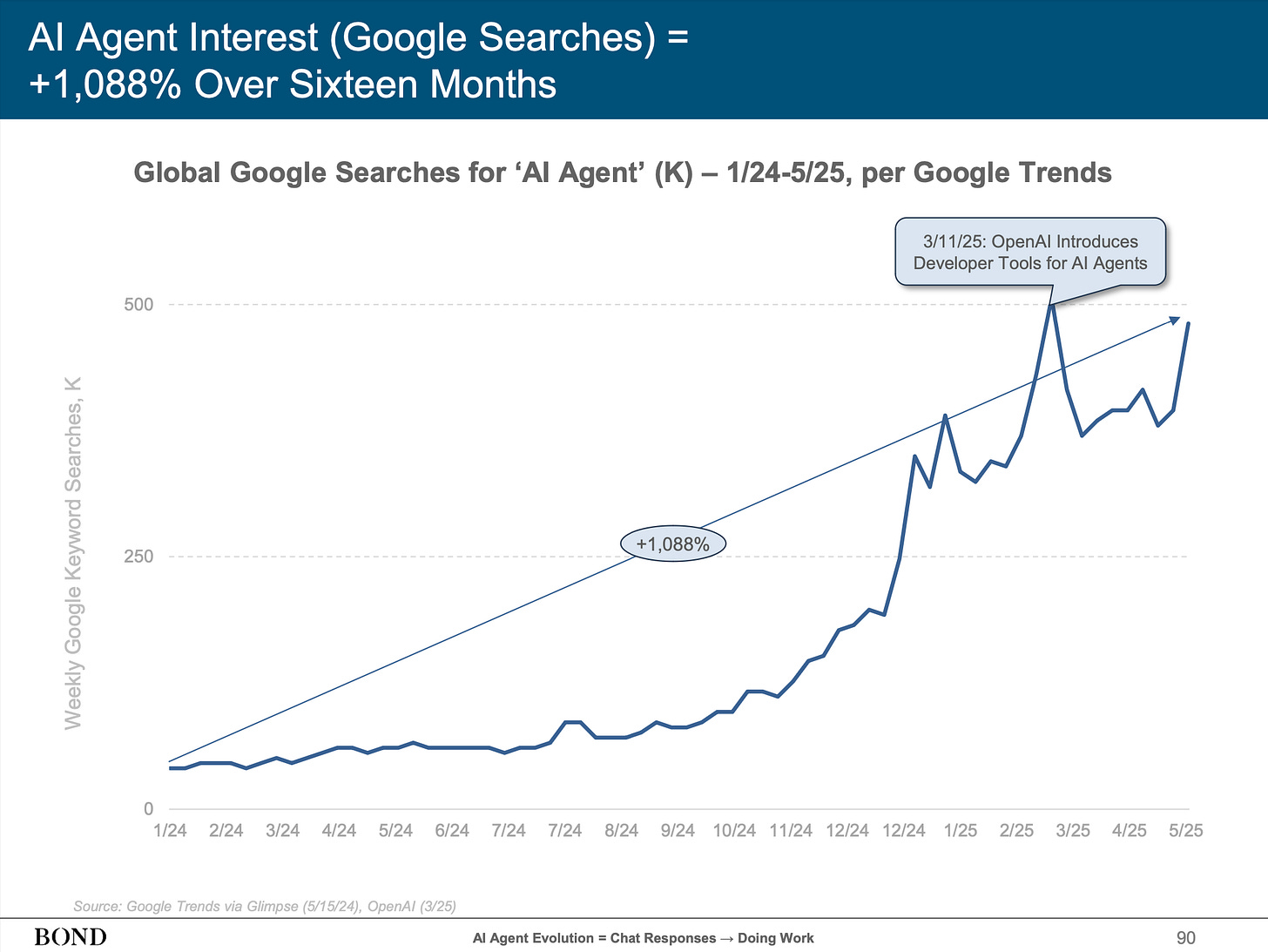

10. The Final Battleground: The Interface

This all culminates in the next great strategic shift. The report argues that as AI becomes ambient, the primary way users interact with technology will move from apps and websites to conversational, agentic interfaces. The ultimate winner in the AI era may not be the company that owns the best model or the biggest app, but the one that owns the primary interface through which users manage their digital and physical lives. This represents a fundamental reordering of the tech stack and poses a significant threat to every incumbent.

The Key Takeaways for Leaders

The game has fundamentally changed. The cycle of building a product, finding product-market fit, and scaling is being compressed from years into months. Your competitive advantage will no longer be determined by your existing business model or technology stack, but by your organisation's ability to allocate capital, integrate new tools, and adapt your strategy at this new, unforgiving velocity.

The risk isn't making the wrong bet on AI; it's standing still.

What the Report Missed

While BOND’s analysis provides an essential 'what,' it leaves some critical 'how' questions unanswered from a strategic execution standpoint.

It outlines the need for a skilled workforce. Still, it doesn't address the immense challenge of organisational redesign and the large-scale re-skilling required to pivot an entire company's operating model around AI.

It touches on geopolitics but largely sidesteps the messy, tactical reality of navigating the rapidly evolving global patchwork of AI regulation, a significant compliance and operational risk for any company deploying these tools at scale.

It highlights adoption metrics without fully exploring the actual total cost of ownership (TCO) and the long-term technical debt incurred when integrating these powerful, fast-moving systems into legacy enterprise infrastructure.

Great summary JR - I had this in my reading file… you just saved me a few hours